The Tax Administration on internet sales under the Cash Register Systems Act and the Bookkeeping RegulationĮlectronic invoices are sent as a data file by the invoice issuer to the recipient. If you have a service where the customers can order goods online, but have to pick up the goods in a physical store, the sale is considered a regular cash sale. Online sales (E-commerce) is sales whereby the customer both places an order and makes the payment via an online solution without having to go to a physical store.

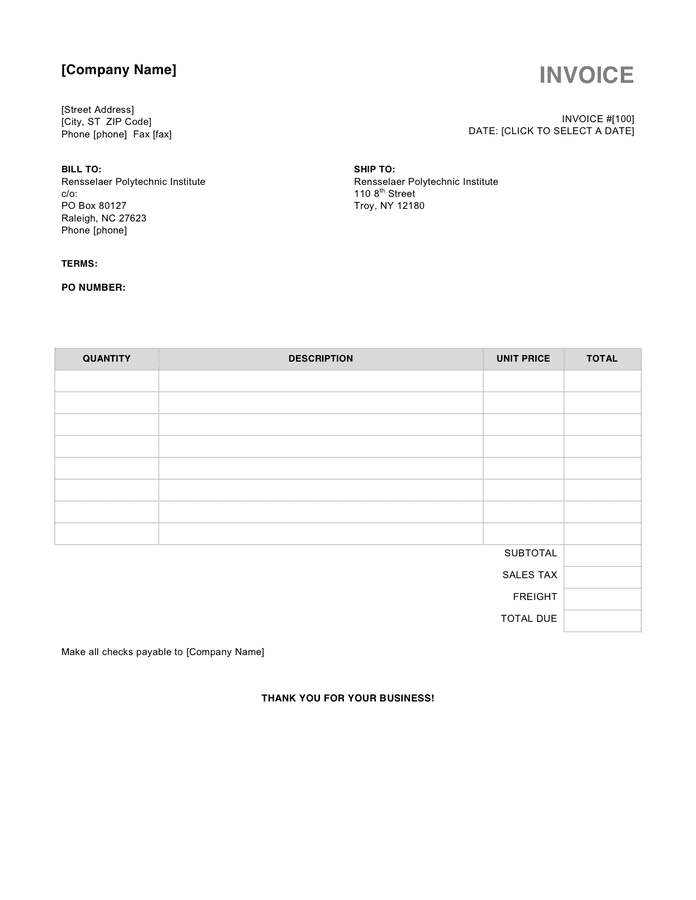

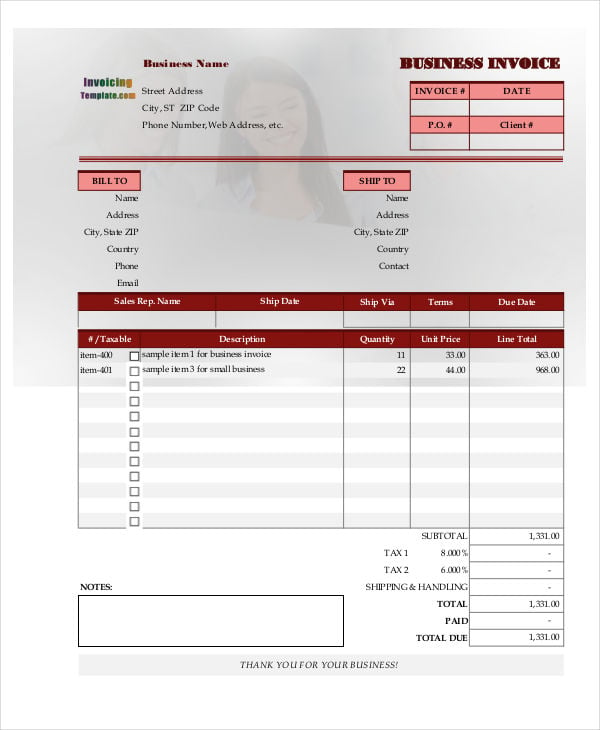

This applies even though the sale can be considered a cash sale according to the Bookkeeping regulations. If you sell goods or services online (webshop, apps and so on), you must document the transaction following ordinary rules for credit sales (invoices). The Norwegian Accounting Standards Board on the issuing of credit notes (in Norwegian only) A credit note should always contain a reference to the original invoice when used to correct errors in previous invoices. The same documentation requirements apply to credit notes as apply to invoices. Credit notes are used to correct previous invoices. If you have sent out an incorrect invoice or if you wish to change an invoice that has already been issued for any other reason, you can generate a credit note. The Bookkeeping Regulations on documentation of sales of goods and services (in Norwegian only) If you have different VAT rates, these must also be specified on separate lines in the invoice. sales which are subject to VAT) and non-vatable sales on the same invoice, you must specify these sales on separate lines. Example: Bedriften AS, org.nr 123 456 789 MVA Foretaksregisteret. The same applies to Norwegian registered foreign enterprises (NUF) that are registered in the Enterprise Register. In the case of private limited companies (AS) and public limited companies (ASA), the word 'Foretaksregisteret' (Enterprise Register) must be stated on the invoice.

In this case, the enterprise name and organisation number must also be stated. Use invoice forms with invoice numbers pre-printed by a printing firm.Use an invoicing program where the invoice number is assigned automatically, or.There are therefore only two ways in which you can issue an invoice:

0 kommentar(er)

0 kommentar(er)